Understanding Financial Statements

A Guide for Business Owners

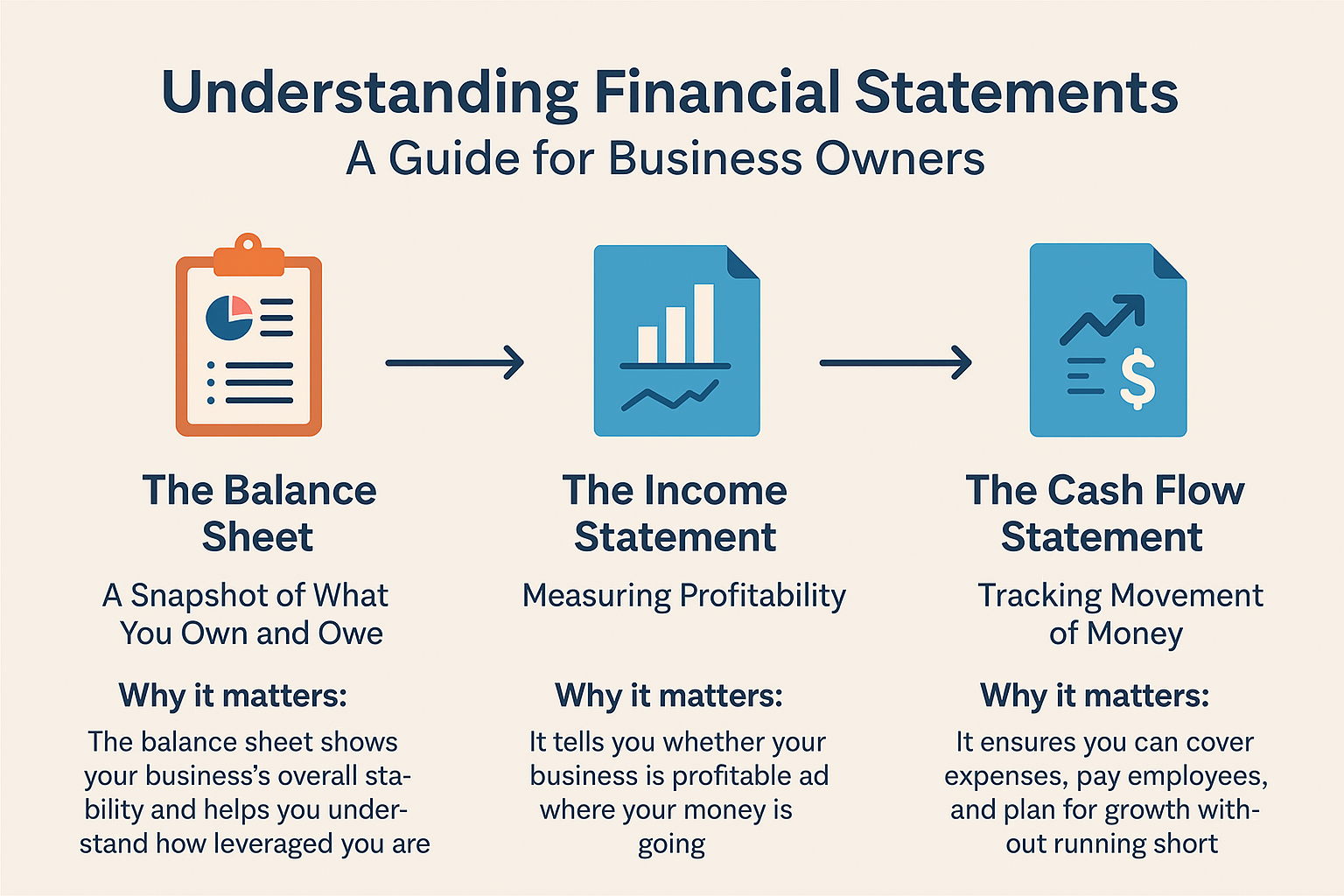

Financial statements are the roadmap to your business’s financial health. Yet many small business owners see them as a mystery—numbers, charts, and terms that feel more confusing than helpful. The truth is, once you understand what these statements are telling you, they become powerful tools for making better business decisions.

At LOV Bookkeeping, we help clients go beyond just “having the books done.” We make sure they understand what their numbers mean. Here’s a simple breakdown of the three key financial statements every business owner should know.

1. The Balance Sheet: A Snapshot of What You Own and Owe

The balance sheet gives you a moment-in-time view of your company’s financial position.

It includes three parts:

- Assets — what your business owns (cash, inventory, equipment, etc.)

- Liabilities — what your business owes (loans, credit cards, accounts payable)

- Equity — what’s left after liabilities are subtracted from assets

Why it matters: The balance sheet shows your business’s overall stability and helps you understand how leveraged you are with debt versus owned assets.

2. The Income Statement: Measuring Profitability

Also called the profit and loss (P&L) statement, this report shows your revenue and expenses over time—monthly, quarterly, or annually.

Why it matters: It tells you whether your business is profitable and where your money is going. With a good bookkeeping system, you can identify which areas are performing well and where costs might be trimmed.

3. The Cash Flow Statement: Tracking Movement of Money

While the P&L shows profit, the cash flow statement tracks actual money coming in and going out. You can be profitable on paper but still have cash shortages—this report helps you avoid that.

Why it matters: It ensures you can cover expenses, pay employees, and plan for growth without running short.

Bringing It All Together

When you understand how these three statements connect, you gain a full picture of your financial health. For example:

- A profitable P&L doesn’t always mean strong cash flow.

- A high debt load on your balance sheet may signal future cash crunches.

- Tracking these together lets you make smarter, data-driven business decisions.

How LOV Bookkeeping Helps

We don’t just prepare your reports—we walk you through them. Our clients learn how to read and interpret their financials so they can confidently steer their business toward growth.

Understanding your numbers means understanding your business—and that’s the key to long-term success.