How Bookkeeping Helps You Start the New Year Right

A new year brings new goals, new opportunities, and a fresh chance to move your business forward with confidence. But before you can set smart financial goals for the year ahead, you need a clear picture of where you’ve been—and that’s where bookkeeping plays a vital role.

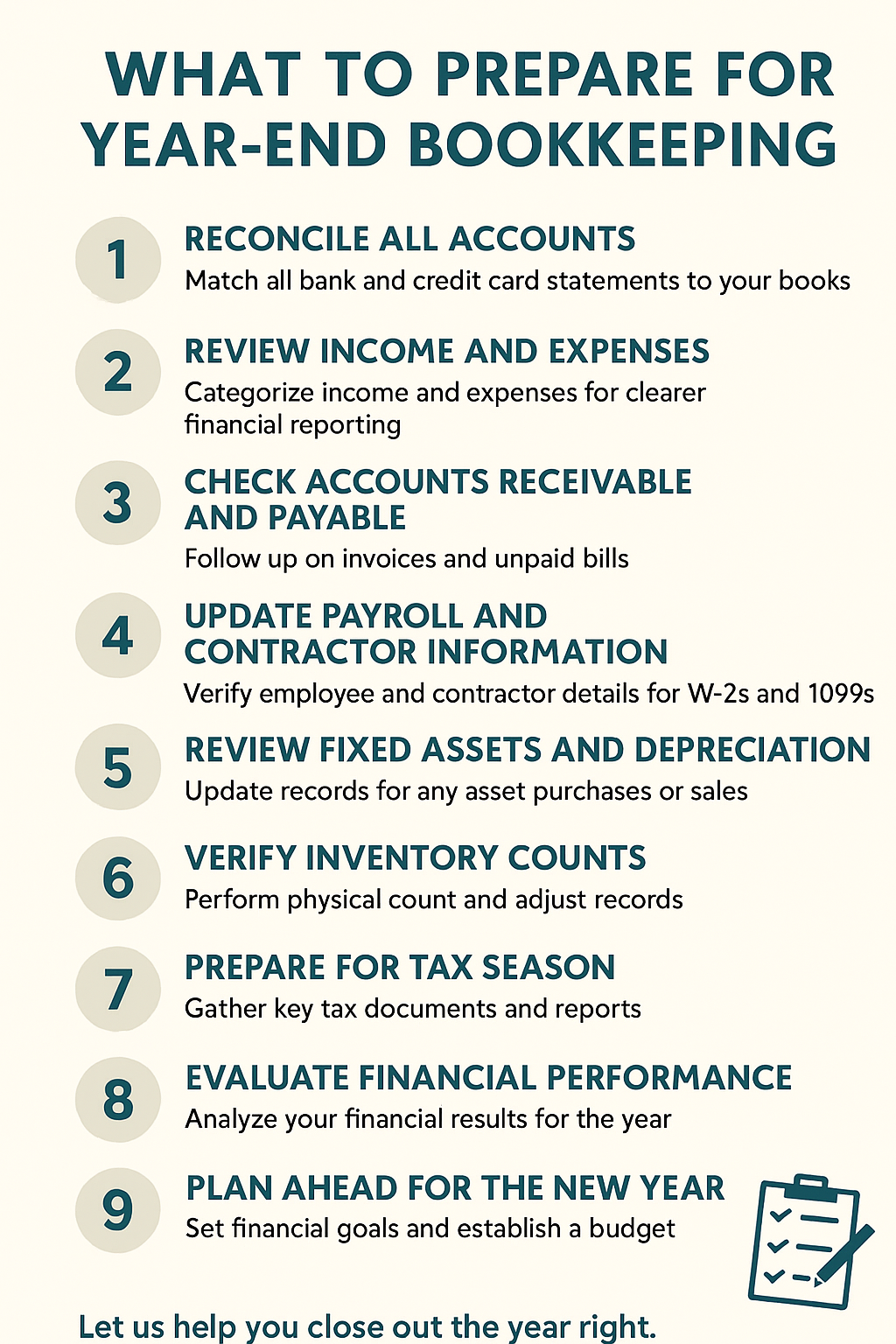

Accurate bookkeeping gives you the financial visibility needed to make informed decisions. Here’s how wrapping up the year properly sets you up for success:

Reflect on Your Financial Performance

With up-to-date books, you can review:

- Total revenue and growth patterns

- Profit margins and cash flow

- Top expenses and spending trends

Understanding what worked (and what didn’t) helps you make better choices going forward.

Set Strong, Achievable Goals

When your finances are clear and organized, you can:

- Build realistic budgets

- Plan for tax payments and seasonal swings

- Identify opportunities to cut costs or invest in growth

This ensures that every financial goal is tied to data—not guesswork.

Improve Cash Flow from Day One

Clean books highlight unpaid invoices, recurring subscriptions, or inefficiencies that may be draining cash. Fixing these early keeps your business financially healthy all year long.

Reduce Stress with Tax Season Ahead

Proper bookkeeping means:

- Your documents are organized

- Deductions are easier to track

- You avoid last-minute scrambling in March or April

A smooth tax season starts with accurate records now.

Start the New Year in Control

Bookkeeping isn’t just about compliance—it’s about clarity. When you begin the year with accurate finances, you gain the confidence needed to take smart risks, invest wisely, and grow with purpose.

If you want to start the new year right, LOV Bookkeeping is here to help you set the foundation for lasting success. Let’s make this your best year yet!