Understanding the Difference Between Basic and Comprehensive Bookkeeping Services

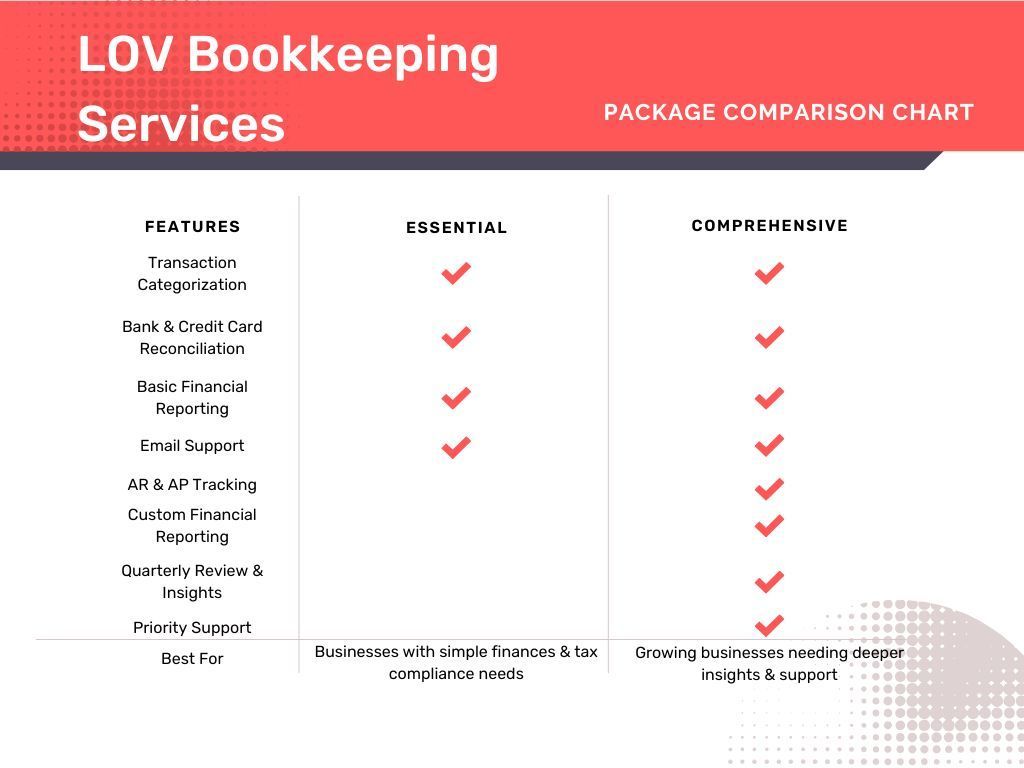

As a small business owner, keeping your finances in order is essential for success. But not every business needs the same level of bookkeeping support. At LOV Bookkeeping, we offer two service tiers to match your needs: the Basic Package and the Comprehensive Package. Understanding the differences between these options will help you choose the best fit for your business.

Basic Package: Essential Bookkeeping

The Basic Package is designed for businesses that need fundamental bookkeeping to stay organized and compliant. It includes:

- Transaction Categorization – Accurate classification of income and expenses.

- Bank & Credit Card Reconciliation – Ensuring your records match your financial accounts.

- Basic Financial Reports – Monthly Profit & Loss (P&L) and Balance Sheet.

- Email Support – Quick answers to bookkeeping-related questions.

This package is ideal for businesses with straightforward finances, limited transactions, and those primarily looking to stay compliant with tax reporting.

Standard Package: Comprehensive Bookkeeping

For businesses needing deeper financial insights and additional support, our Comprehensive Package includes everything in the Basic Package plus:

- Accounts Receivable & Accounts Payable Tracking – Stay on top of who owes you and what you owe.

- Customized Financial Reports – Gain a clearer understanding of cash flow and profitability.

- Quarterly Review & Insights – In-depth analysis to help guide business decisions.

- Priority Support – Faster response times for your bookkeeping questions.

This package is best for businesses experiencing growth, managing multiple financial accounts, or requiring more frequent financial insights for decision-making.

Which Package Is Right for You?

If your business is relatively simple, and you mainly need financial records kept in order, the Basic Package may be sufficient. However, if you require deeper financial insights, cash flow tracking, and proactive business guidance, the Comprehensive Package will provide better value.

Every business is unique, and we understand that one size doesn’t fit all. If you need a customized solution, we can design a bookkeeping package tailored to your specific needs.

Still unsure? Contact us today for a free consultation, and we’ll help you determine the best package for your business.