Bookkeeping Lessons from the North Pole

December 12, 2024

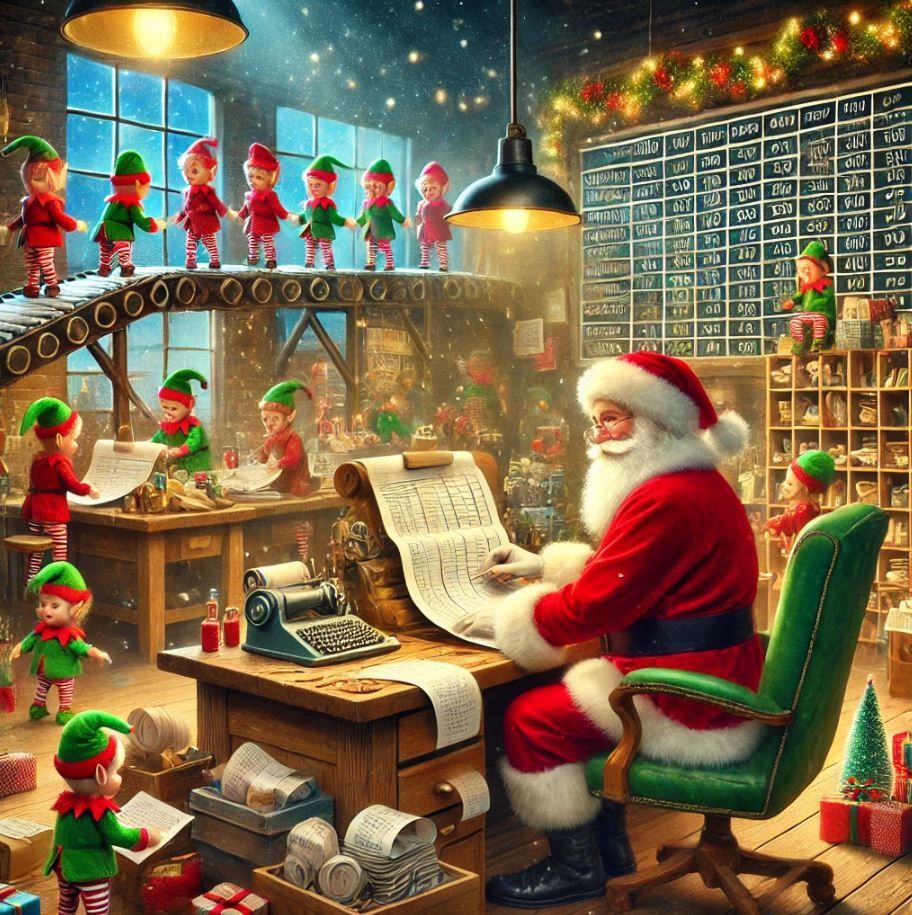

As the year draws to a close, even Santa has to make sure his books are balanced and his workshop runs smoothly! Let’s take a peek into the bookkeeping secrets of Santa’s workshop to see what small businesses can learn from the North Pole.

Bookkeeping Lessons from Santa's Workshop

- Inventory Management: Tracking Toys and Supplies

Santa needs to know exactly what toys and materials are on hand to ensure every child gets what they wish for. Similarly, small businesses can benefit from keeping track of their inventory to avoid year-end surprises and stay organized. - Budgeting for a Big Day

Santa has one massive delivery night, and he plans all year to stay within budget. For small businesses, December is a great time to set next year's budget, based on the year’s financial insights and goals. Take time to review the current year and make a plan for next year! - Tracking Expenses: Feed for the Reindeer

Just like Santa must account for reindeer feed, small businesses need to categorize expenses to understand where funds are going and plan for tax deductions. It’s a magical way to reduce stress come tax season! - Managing Payroll: Keeping the Elves Happy

Santa knows that happy elves mean a productive workshop. Accurate payroll is just as crucial for small business owners to keep employees motivated, especially as year-end bonuses or holiday pay come around. - Reviewing the Year’s P&L (Profit and Loss)

Santa has to assess how well he met his “nice” or “naughty” goals for the year. Small businesses can do the same by reviewing their profit and loss statements, gaining insight into what worked well and what could be improved.

Conclusion

If Santa can keep his books balanced in time for Christmas, you can too! With the right processes in place, a little year-end bookkeeping magic will set your business up for a fantastic new year. And if you need a little extra help, LOV Bookkeeping is just a sleigh ride away to assist with all your year-end needs.

Many small business owners assume that if their company is profitable, they must be financially healthy. Unfortunately, that’s not always true. One of the most common financial misunderstandings is confusing profit with cash flow . While they are connected, they are not the same—and understanding the difference can protect your business from serious financial stress.

A new year is the perfect time for small business owners to reset, refocus, and build better financial habits. While motivation is high in January, the businesses that truly succeed are the ones that rely on systems and routines—not guesswork —to manage their finances. Strong bookkeeping habits create clarity, reduce stress, and support smarter decision-making all year long. Here are the essential financial habits every small business should establish to start the year strong.

A new year brings new goals, new opportunities, and a fresh chance to move your business forward with confidence. But before you can set smart financial goals for the year ahead, you need a clear picture of where you’ve been—and that’s where bookkeeping plays a vital role. Accurate bookkeeping gives you the financial visibility needed to make informed decisions. Here’s how wrapping up the year properly sets you up for success: