Preparing Your Business Accounting for a Strong Year-End

Introduction

The end of the year is the perfect time to get your finances in order and set up for a smooth start in the new year. By closing out your books correctly, you ensure accuracy in your records and make tax season far less stressful. Some businesses experience a bit of a slowdown starting in late November and through the rest of the year as people start taking time off for the holidays. This is a perfect opportunity for you to focus on cleaning up your books and getting your accounts in order.

Key Steps to Prepare Your Bookkeeping

- Reconcile All Accounts

Ensure your bank and credit card statements match up with your books, so there are no discrepancies. Review loan balances to make sure you categorize interest and principal correctly and don’t miss out on interest expense deductions.

- Review Outstanding Invoices and Bills

Review customer agings to look for cash that can be collected or potentially write off balances that may be uncollectible. Again, don’t lose a deduction that you can take this year. Settle outstanding bills. If you are a “cash basis” business, then paying those invoices a little earlier (prior to year-end) may make sense so you can deduct the expense in the current year. Additionally, if you have terms that allow for an early payment discount, it may make sense to pay a little early as well. - Categorize Expenses

Properly classifying expenses now can simplify tax filing and improve financial clarity for year-end reports. This is about getting ahead of the work. If you are a little slow and January is going to take off, get ahead now. - Organize Tax Documents

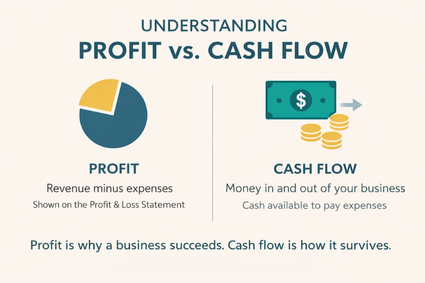

Gather receipts, payroll records, and other tax-related documents to make filing easier. - Review Financial Statements

Look at your profit and loss statement, balance sheet, and cash flow statement for insights into how the business performed this year. This is a great time to review what is working and what may not be working. These statements can help you figure that out. - Plan for Next Year’s Budget

Use this opportunity to set goals and prepare a budget based on this year’s results. Personally, I’m not a big fan of budgets, but I do like to make goals and plans. I use the end of the year to look at what I want to accomplish next year and set monthly and quarterly goals to help keep me on track.

Conclusion

Year-end bookkeeping is a bit of a chore, but it’s a crucial step toward understanding your financial performance and making the new year as successful as possible. LOV Bookkeeping is here to support you in every step of this process, ensuring you start January with confidence and clarity.