Master Your Real Estate Finances with These Key Tips

For real estate professionals, managing finances can be just as crucial as closing deals. Whether you’re a broker, property manager, or real estate investor, maintaining a solid financial foundation is essential to growing your business and sustaining profitability. Here are three common financial challenges and how you can address them to improve your bottom line.

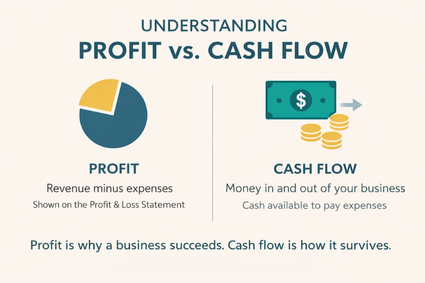

1. Cash Flow Management

One of the biggest challenges for real estate professionals is managing cash flow, especially when dealing with inconsistent income streams. For example, property managers may experience gaps in rental income due to vacancies, and real estate agents often deal with fluctuating commission payments. Creating a detailed cash flow plan can help you anticipate these fluctuations and set aside funds during high-income months to cover leaner times.

2. Expense Tracking

It’s easy to lose track of day-to-day business expenses, but poor tracking can lead to financial inefficiencies and missed tax deductions. Implementing a system to categorize expenses—such as office supplies, marketing, and property maintenance—will ensure you know where your money is going and help you maximize deductions at tax time.

3. Tax Planning

Real estate professionals often face complex tax scenarios. Regular tax planning is vital to minimizing your tax liability while remaining compliant with local regulations. Work with a bookkeeper or accountant who understands the real estate industry to ensure you're making the most of tax deductions like property depreciation and mortgage interest.

By addressing these challenges head-on, real estate professionals can set their businesses up for long-term success. Need help? Reach out to us for customized bookkeeping solutions!