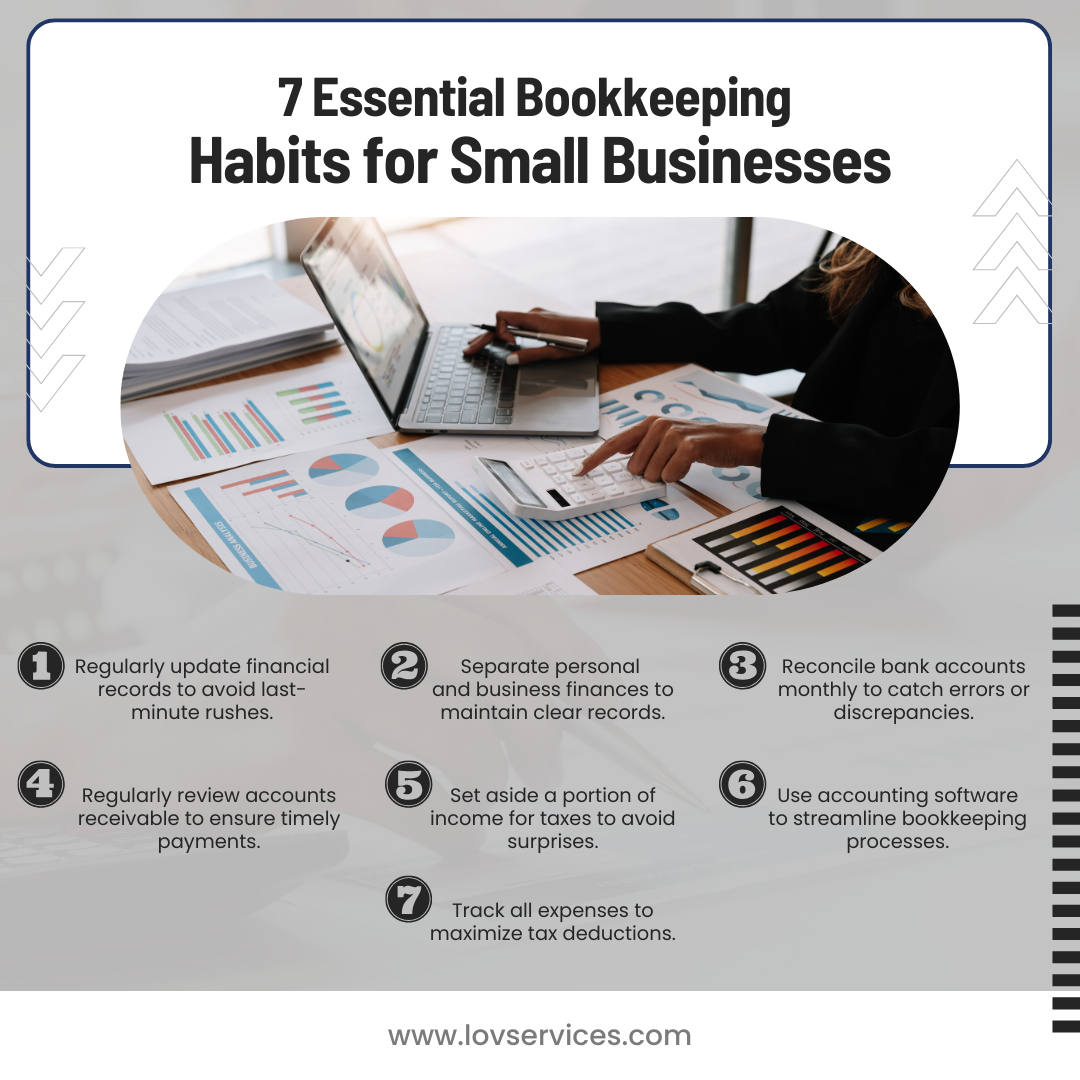

7 Bookkeeping Habits for Small Businesses

Maintaining accurate and up-to-date bookkeeping is essential for the success of any small business. As a small business owner, it's crucial to develop good bookkeeping habits to ensure the financial health of your company. Here are seven essential bookkeeping habits that every small business should adopt:

- Regularly update financial records: Avoid the last-minute rush by making a habit of updating your financial records on a consistent basis, whether it's daily, weekly, or monthly. This will help you stay on top of your finances and make informed decisions.

- Separate personal and business finances: It's important to keep your personal and business finances completely separate. This will make it easier to track expenses, generate accurate financial reports, and ensure compliance with tax regulations.

- Reconcile bank accounts monthly: Make it a habit to reconcile your bank accounts on a monthly basis. This will help you catch any errors or discrepancies early on, preventing larger issues down the line.

- Review accounts receivable regularly: Stay on top of your accounts receivable by reviewing them regularly. This will help you identify any late payments or outstanding invoices, allowing you to take prompt action to collect the owed funds.

- Set aside a portion of income for taxes to avoid surprises. Similar to having an emergency fund, this will help you to make sure you can cover your tax payments without having to resort to borrowing.

- Use accounting software to streamline bookkeeping processes. If you’re small enough, you may be able to do your books on excel or with receipts, but most small businesses should have accounting software that matches their needs.

- Track all expenses to maximize tax deductions. If you’re already practicing habits 1 thru 6, this should be happening. However, it’s worth a special mention here!

By adopting these seven bookkeeping habits, you'll be well on your way to maintaining a strong financial foundation for your small business, allowing you to focus on growth and success. At LOV bookkeeping, we work with small business owners to make sure they have these processes in place and they are being followed. We can take care of the heavy lifting here while you focus on doing the things that help grow your business.