Financial KPI’s

Financial KPIs (Key Performance Indicators) are essential metrics that provide invaluable insights into the financial health and performance of a business. By closely monitoring and analyzing these KPIs, business owners and leaders can make informed decisions that drive growth, optimize operations, and ensure long-term sustainability.

One of the primary reasons why financial KPIs are so important is that they offer a clear and objective way to measure the financial performance of a company. These metrics can help identify areas of strength, as well as areas that require improvement, allowing businesses to allocate resources more effectively and make strategic adjustments as needed.

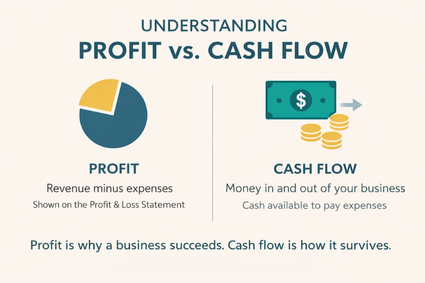

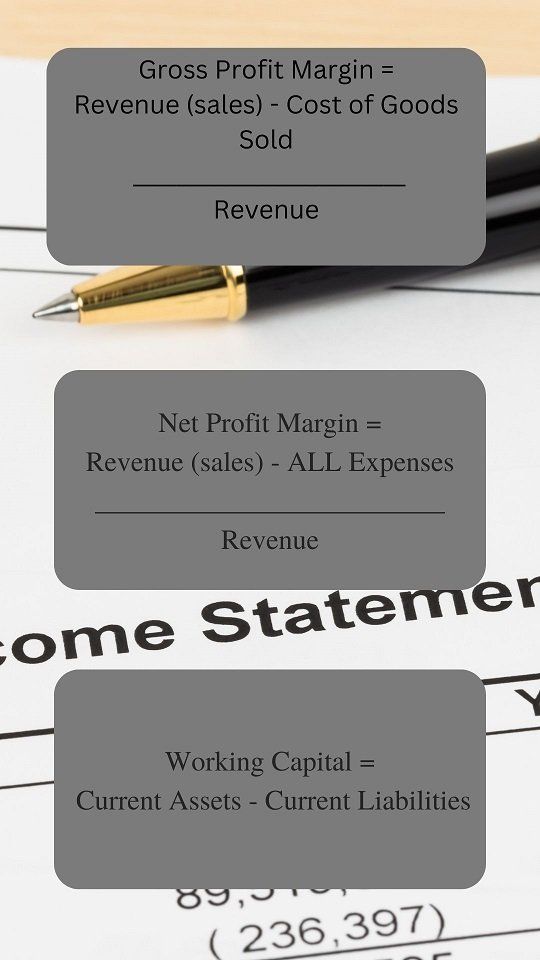

When it comes to financial KPIs, there are several key areas that businesses should focus on, including revenue, profitability, liquidity, and efficiency. Revenue-based KPIs, such as total revenue, revenue growth, and customer acquisition cost, provide insights into a company's ability to generate income. Profitability KPIs, like gross profit margin and net profit margin, reveal the company's ability to convert revenue into profit. Liquidity KPIs, such as current ratio and quick ratio, indicate a business's ability to meet its short-term financial obligations. Efficiency KPIs, like inventory turnover and accounts receivable turnover, showcase how effectively a company is utilizing its resources.

Three of these KPI’s are listed below with their respective formulas. As always, before you can begin to track KPI’s you have to have good financial data and reports. That is the foundation for being able to efficiently track performance.

By closely monitoring and analyzing these financial KPIs, businesses can make informed decisions, identify areas for improvement, and ultimately drive long-term success and growth.