Year End Part Three: Chart of Accounts

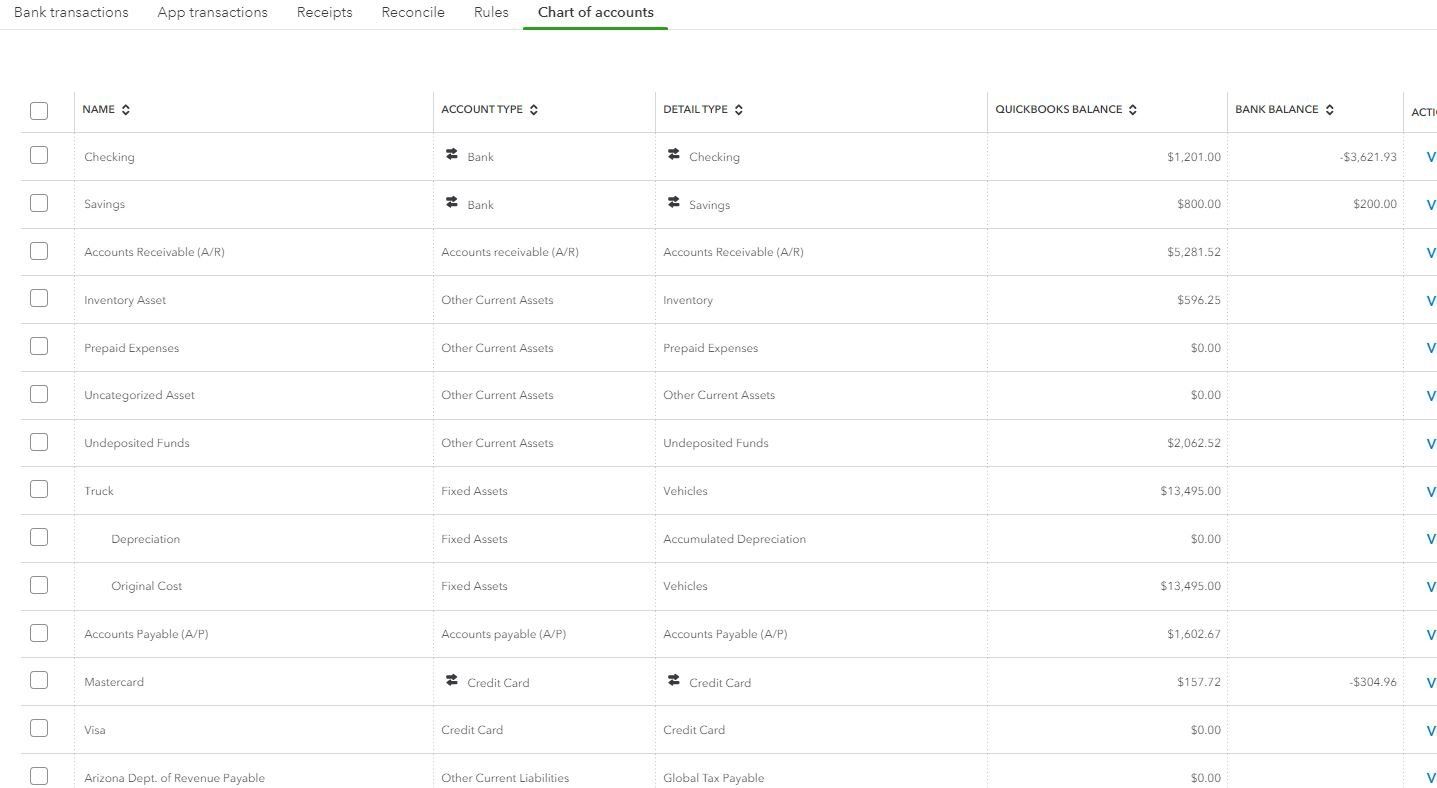

So, we have reconciled the accounts and we have reviewed and entered our personal expenses and transactions in preparation for year end. Now we turn to the Chart of Accounts, which looks something like this in QuickBooks Online:

Sample Chart of Accounts

Here, you will review each account to look for potential errors. Most of these accounts you should be familiar with and be able to look at the balance to determine accuracy. For example, if you carry small amounts of inventory and you know how much you have, maybe in the above example you see the $596.25 and are able to quickly determine that it looks accurate. If you don’t carry inventory at all, you might want to dig deeper to determine what is causing this amount to show up as inventory on your books.

The more obvious places to look would be any account that has “Uncategorized” in the title. These definitely need to be addressed and categorized correctly before moving on to the next steps. While you should be able to review these accounts and spot errors without too much trouble, you may have difficulty in knowing exactly how to correct them. This is where you want someone familiar with your accounting system to help out.

If you are in this position, we are happy to help. We will review your system and help to highlight and address these kinds of errors. Reach out to learn more!